We’ve moved our blog to http://blog.novarica.com. Please update your bookmarks, and thanks for visiting!

We’ve Moved: http://blog.novarica.com

March 4, 2009Canadian P&C Insurers: Full Speed Ahead on IT for Distribution and Policy Admin

February 23, 2009Just back from the Insurance Canada P&C Technology event in Toronto. There were many strong sessions, and a great attendee group. We had the opportunity to present the results of our insurer and broker research on the Canadian market which we’ll be publishing shortly. According to our research, Canadian P&C insurers of all sizes are continuing to increase their IT spending, with a universal focus on distribution and policy administration systems/legacy system modernization.

If you’re interested in our Canadian research, please contact me at mj@novarica.com

Agency Connectivity Market Navigator Published

February 23, 2009Reporting from LOMA Distribution Technology Conference

February 19, 2009I’m down here in sunny (but cold) San Diego attending the LOMA Distribution Technology Conference. There have been some very interesting presentations so far. Most of the sessions I’ve seen so far are looking at the power of using new internet technologies to drive marketing.

There’s a lot of buzz during the breaks about the sessions on how to use social networking tools, when to use aggregators, and which web marketing techniques are best for driving production. One session focused on techniques for implementing new technology to agents, and another focused on generational differences in preferred methods for interacting with insurance carriers.

Whether it’s utilizing web 2.0 to design new products, or using straight through processing on the web to expand your distribution channel, it’s clear that carriers are doing more than just thinking about emerging distribution technologies.

The key is making sure that an appropriate ROI is being generated from moving into these new areas. That means setting appropriate goals for new marketing initiatives, choosing the right technologies to enable initiatives, and implementing the initiatives appropriately.

OFC Gaining Momentum?

February 15, 2009Hmmmm…Looking more like I might be buying Chad a drink at ACORD-LOMA. Investment News reports that NAIC now supports consideration of an optional federal charter, leaving only NAMIC and IIBIA still firmly opposed. NAIC is also moving its headquarters to DC for the first time.

I wonder if NAIC has seen the writing on the wall, and been swayed somewhat by the Royce-Bean Bill’s requirements that the new national regulator maintain physical offices in every state (nationalizing the DOIs)

I still don’t think this is a done deal, but I have to admit, the odds are not running in favor of my original prediction that Democratic governors and house members would block this initiative.

Survey of Realtime Users Shows Usage of Realtime

February 11, 2009Interesting survey out this week from GetRealTime.org, the ACT/Augie/ACORD group promoting agency management system connectivity as the path for carrier/agent communication. I&T had a good article about it here. Of the 3,200 agents surveyed, the majority are using realtime (or, as it used to be known, agency management system bridging) to communicate with insurers.

Notable in the survey though was the high disparity between personal lines and commercial lines adoption. While it was not stark for inquiry (87% of agents reported using realtime for personal lines billing inquiry v. 75% for commercial lines), quoting was miles apart at 43% of respondents quoting personal lines through realtime compared to only 18% for commercial lines.

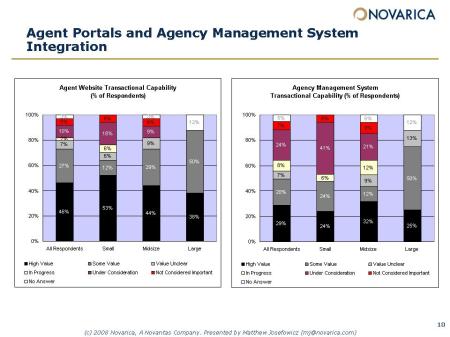

In our P/C CEO survey in 2008 (webinar here), most CEOs were more enthusiastic about the value of their own portals than their agency management system connectivity efforts. However, we believe that carriers should carefully consider the benefits of an integrated strategy that combines both portal functionality and integration with management systems.

The Novarica Market Navigator report on solution providers that enable agency management system connectivity is coming out this week. Stay tuned!

Update: Report published!

Manage Your Reputation Online

February 10, 2009With looming layoffs and a declining economy, reputation management is an area that is getting more attention by Marketing VP’s. It used to be commonly thought that a person who has had an unpleasant experience with a business would tell 9 or 10 other people. But with the rise of social networking, that can quickly become thousands who hear a negative message. And if that message rises to the top of a search request, it can spread like a virus, quickly escalating into a brand marketer’s nightmare. Launching a solid reputation management strategy may utilize a variety of techniques.

Blogging or utilizing social networking through forums such as Twitter, Facebook and MySpace are clearly tools that can be used to build an online reputation. But other tools such as community building, link strategies, search engine optimization, online publicity, online editorials, and even product reviews are all tools that can be used to help manage a company’s online reputation.

We’re seeing increased interest from insurance carriers in utilizing these techniques. Look for Twitter accounts with insurance in their name and you’ll find 105 Tweeters. Check out Facebook and you’ll find over 500 profiles.

Marketers will come to IT for advice on how to get started in these areas. Check out some of the research that we’ve done on Web 2.0, Website Optimization, and Tips for Tweeting. Got a question about Web 2.0? Ask it through the comment field or send me an email at kcarnahan@novarica.com.

Ingenix Settlement bodes ill for loss minimization strategies

February 6, 2009The recent Ingenix settlement with the New York AG should serve as a warning to insurers that strategies based on managing loss costs after a claim has been made will increasingly be under scrutiny by regulators and AGs. No one ever lost votes by making insurers pay more in claims payouts. Insurers need to increase their focus on risk selection, pricing, operating efficiency, and most importantly, loss control in order to ensure profitability.

Improving Agency Relationships with Technology

February 4, 2009The Winter 2008 IIABNY Report on Carrier Performance is out. You can read the Executive Summary here. The IIABNY Index is composed entirely of ratings from agency principals or leaders responsible for carrier relations in New York. While it’s a small sample, it is an interesting study.

The study surveys agents across six dimensions of their carrier relationships. The second dimension measured is Technology and documentation are easy to use. It’s notable that this factor increased for all carrier types except regionals where it dropped slightly.

Now of course, technology didn’t get worse for regionals. They didn’t withdraw or decommission critical technology for their agents. What changed is agent expectations. As the marketplace continues to improve their capabilities, those who stand still are penalized. That’s probably why we’re seeing a continuing interest in technologies that help carriers improve their ease of doing business with agents.

Social Media and Engagement

February 4, 2009The February 2009 issue of Best’s Review has a cover story, “Crashing the Party,” about how some insurers are using social media as an effective marketing tool (specifically, Allstate and Esurance).

Karlyn Carnahan has touched on social media strategy as well, both on this blog and in her recent report. Even low-investment tactics, like adding widgets to allow customers to share website content via Delicious, Digg or Google Reader can have an impact in growing your brand and increasing engagement with existing and potential customers.

Like the one below this post 🙂